You wouldn’t expect there to be much silver related news between Christmas and the 5th of January – but you’d be wrong.

For one, the elephant in the room: The Trump administration accomplished a surprise extraction of Venezuela’s President Maduro.

Venezuela does have some unknown and untapped supply of silver reserves in a mineral-rich area known as Arco Minero del Orinoco, but that’s not the meat of this story.

Deposing a world leader in Latin America creates geopolitical disruption and uncertainty. People buy risk-off assets like gold and silver when they don’t know what else to do.

Venezuela is allied with China, and the revelation that a team of American Delta Force operators can whisk a country’s leader away, at will, undermines every relationship between and among America’s adversaries. If Maduro can get deleted, why not literally any other leader of a China-friendly country? Forget instability in Venezuela, the whole Latin American order is jumbled and uncertain.

Consider: the $75/ounce silver mark was broached well before taking Maduro… meaning the price does not yet reflect this news.

At the same time, we’re now on the other side of the end of widespread silver exports from China.

Starting on January 1, 2026, China started heavily restricting silver exports. Reminder that China was the largest exporter of silver, exporting something like 60% of all silver per year…

Then, yesterday, the U.S. Dept of Defense announced they were funding a silver smelter in Tennessee, to the tune of $7.4 billion. The project is designed to create a reliable domestic supply of refined silver.

Remember not so long ago when industry was considered yucky for the environment? Climate change was very important, once upon a time.

Now? It’s fire up the smelters, we’re making America silver again.

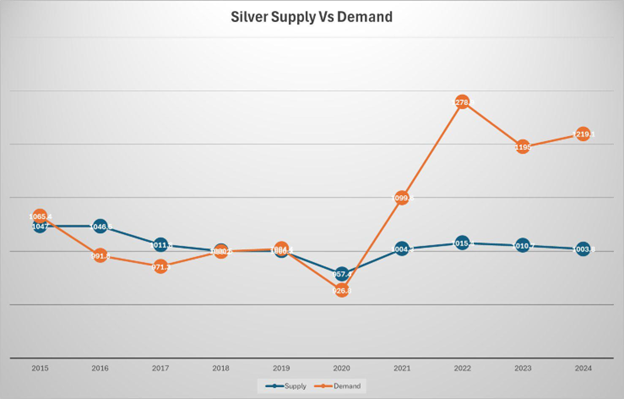

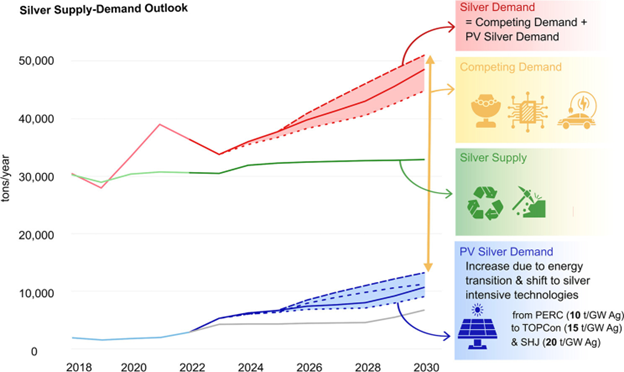

Meanwhile, all of the same supply/demand constraints are still in place. Silver usage has swamped supply for years now, and is projected to grow further.

Solar panel use alone could use 500 million ounces per year by 2030 – or close to half of all production.

Obviously all of this news is incredibly bullish for silver. It’s now en vogue to casually talk about $100 silver coming very soon.

As a fan of silver, you can allow yourself to feel a little smug about being ahead of the curve on what’s transpiring.

Good job, you were right, savor the moment.

But as an investor, you need to be as shrewd as possible. The main street money is coming, and quick.

Retail investors are discovering the same precious metals narratives you and I were talking about a year or a decade ago.

When the retail public comes into the picture, that’s when the biggest gains come. They bid up the price of everything that has gold or silver in the name: the good, the bad and the fraudulent.

But bull markets only last years – not forever.

That’s why I told people two weeks ago to take some profits.

Bull markets are for taking profits…

We’re not married to our gold and silver stocks: we’re dating them, short term.

Be patient, not greedy, and you’ll be way ahead of the crowd during the next phase of this bull market.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio

P.S. The “signs” are everywhere that gold is coming back into the monetary system in a big way. If you don’t understand why Central Banks are dumping U.S. Treasuries and buying gold at the fastest pace on record – for four years and counting…

You need to set aside time to watch my recent interview with my old friend, Porter Stansberry. Porter hosted me at his farm outside Baltimore to discuss the enormous monetary shift underway today – and gold still has years left to run. We also share the best way to play this ongoing gold bull market. To help you, I’m revealing my top-performing portfolio ever – a basket of 17 gold stocks that would have already handed you over 325X your money since 2007. I don’t want to say too much here…

But please make a note to check your inbox this coming Wednesday, January 7, at 11 a.m. ET. That’s when I’ll release my recent sit-down interview with Porter – and show you the single best way to invest in gold for life-changing returns, with far less risk than you get from owning gold miners.